📈Token Utility and Revenue Model

1. Introduction

The Sync Token ($SYNC) powers the SyncAI ecosystem. It fuels every interaction, empowers seamless operations, and unlocks rewards across the network. $SYNC drives high-value transactions, powers cross-chain activity, and incentivizes active participation from users, developers, and node operators. With a well-structured token economy, SyncAI is set to scale rapidly, transforming how ecosystems connect and thrive.

2. Utility and Revenue Models

2.1 Introduction

$SYNC fuels an interconnected Web3 economy by aligning incentives across the ecosystem. The sections ahead reveal how Sync captures value and maximizes opportunities within Web3’s most dynamic sectors.

2.2 Transaction Fees

Transaction fees are the primary revenue driver for SyncAI, ensuring the platform remains sustainable and self-sufficient. Every interaction—ranging from DeFi operations, cross-chain transfers, staking and liquidity movements—processed through SyncAI, with $SYNC tokens used to facilitate transactions. This design creates continuous revenue streams, supporting the treasury and enabling platform expansion.

2.2.1 Core Transaction Fees: A Breakdown

Comprehensive Fee Coverage: Every automated interaction—whether push/pull payments, scheduled transactions, loan repayments, or liquidity movements—is subject to a token fee, payable in $SYNC, ensuring revenue capture across all network activities.

Targeted High-Value Transactions: SyncAI focuses on high-traffic DeFi activities, such as lending, staking, perpetuals, liquidity provisioning, and token swaps, to capture significant transaction volumes within Web3.

Scalable Growth: As more users, dApps, and ecosystems integrate, transaction volumes will grow—driving a flywheel effect of revenue generation, increased token demand, and higher platform adoption.

2.2.2 Revenue from Key Transaction Areas:

DeFi Operations: Fees apply to loan origination, repayments, yield farming, and liquidity shifts on DeFi platforms integrated with SyncAI.

Staking and Reward Claims: The network charges fees for staking, unstaking, and reward distribution activities to ensure efficient liquidity management.

Cross-Chain Transfers: Interoperable transactions between different blockchains generate revenue, with fees applied to cross-chain token transfers and bridging operations.

Push/Pull Payments and Scheduling: SyncAI introduces automated payments and transaction scheduling features, further enhancing utility by charging fees for predictable payment flows across networks.

Derivatives and Perpetuals: The platform collects fees on high-value options, futures, and perpetual trading activities, capturing revenue from protocols with heavy trading volumes.

2.2.3 Market expansion strategy to drive revenue:

The value behind the Sync token is directly aligned with Sync's go-to-market strategy and network economy, ensuring that every interaction enhances both the ecosystem and the token’s utility.

Market Segment

Description

Key Areas

TAM Total Addressable Market

Web3's Most Active and Growing Areas

Sync connects to every major sector in Web3, tapping into high-traffic and high-value transactions across multiple ecosystems. This encompasses the entire Web3 space, including all users and transactions across various chains and dApps.

Layer 1 and Layer 2 Blockchains: Bitcoin, Ethereum, Cardano, Solana, Avalanche, etc.

DeFi Platforms: Loans, liquidity provisions, decentralized exchanges (DEXs)

Rollups and Scaling Solutions: Optimism, Arbitrum, zkSync, Polygon

Real-World Asset Tokenization: precious metals, real estate, and physical commodities on-chain

SAM Serviceable Available Market

High TVL DeFi Platforms Across Different Categories

Sync focuses on the DeFi sector, where Total Value Locked (TVL) represents billions in economic activity. This includes users and protocols across high-revenue categories that are accessible and can be served by Sync's platform and services.

Lending and Borrowing Platforms: Aave, Compound, MakerDAO

Yield Farming and Liquidity Pools: Uniswap, PancakeSwap, Curve

Staking Platforms: Lido, RocketPool

Asset Bridges and Cross-Chain Protocols: Connecting Ethereum, Cardano, and Layer 2 networks

Perpetuals and Derivatives Trading: dYdX, GMX

SOM Serviceable Obtainable Market

Starting with Cardano's Growing Ecosystem

Sync begins its journey on Cardano, focusing on capturing early adoption within both Layer 1 and DeFi markets specific to Cardano. This represents the immediate market that Sync can realistically capture in the short term.

Cardano's Native DeFi Protocols: Minswap, SundaeSwap, Liqwid Finance, etc.

On-Chain Asset Tokenization: Integrating Cardano's real-world asset tokenization platforms

Cardano Governance and DAOs: Providing tools for efficient governance participation

By strategically targeting these market segments, Sync aims to maximize the utility and adoption of the Sync token, creating a robust and scalable ecosystem within the Web3 landscape.

2.3 Ecosystems and dApps

Channel IDs for Secure Access: dApps and ecosystems require Sync tokens to create a channel ID, enabling secure and private interactions with all SyncIDs on the network.

Recurring Notification Fees: dApps that use push notifications, alerts, and scheduled communications within the Sync network pay recurring Sync token fees to maintain these services.

Service Integration Costs: Sync tokens are required to access infrastructure services and AI-powered tools that enhance the functionality of integrated dApps.

By charging dApps and projects for secure connections, notifications, advanced services, and promotional activities, SyncAI ensures consistent token demand and recurring revenue. This structure drives ongoing participation and platform expansion, while supporting a sustainable and scalable ecosystem.

2.3 Developers

Access to Infrastructure and Development Tools: Developers use Sync tokens to access APIs, SDKs, and AI-powered services, empowering them to build and integrate their applications on top of SyncAI Network.

Incentives for Innovation: Developers who contribute valuable solutions are rewarded with Sync tokens, encouraging continuous innovation and fostering a thriving builder ecosystem.

This structure encourages continuous innovation, expanding SyncAI’s ecosystem with diverse applications that drive adoption and platform growth.

2.4 Extra Revenue Avenues

Incentivized Testnet Support and Marketing Campaigns: Projects contribute Sync tokens to participate in incentivized testnet activities, utilize ad space and marketing campaigns, and access launchpad services for promoting new offerings.

Strategic Investments: SyncAI makes strategic investments in startups across Asia that build on the Sync network. These investments are facilitated through SAFT (Simple Agreement for Future Tokens), fostering innovation and securing long-term partnerships.

2.5 Staking and Governance

Securing the Network: Users stake Sync tokens to participate in consensus and maintain network security and integrity.

Staking Rewards: Participants receive additional Sync tokens as staking rewards, incentivizing long-term engagement.

Liquidity Pools: Staked tokens also enhance liquidity, supporting the network’s operational needs and increasing platform efficiency.

Staking helps maintain network security and liquidity while fostering long-term user commitment, ensuring a stable and vibrant ecosystem.

2.6 Node Operations and Delegation Framework

Node operators are crucial for the SyncAI Network, ensuring security, low latency, computation and network consensus. Both node operators and delegators will earn rewards while misbehaving nodes will face penalties in order to maintain the integrity of the network

2.6.1 Node Operations Framework

Phase 0 (Bootstrapping Phase): During this initial phase, a limited number of private nodes will be operational to test and secure the network. The focus will be on stabilizing the infrastructure and ensuring optimal performance. Maintaining security is paramount to ensure that transaction and notification payloads are correctly originated and delivered through the appropriate channels and destinations. To reduce capital expenditure, we will be running Iagon nodes within our infrastructure. Delegators will earn Sync tokens and a portion of the liquidity pool fees, along with IAG tokens earned from running IAGON nodes, thus adding an additional revenue stream during the bootstrapping period.

Expansion Phase: As the network grows and revenue generated from various sources starts flowing into the treasury, more nodes will be introduced. The treasury will continuously refill, creating a circular economy that incentivizes both delegators and node operators. Revenue from liquidity pool fees and IAG tokens will contribute to these incentives, fostering a balanced and self-sustaining ecosystem.

2.6.2 Delegation Framework

SyncAI's delegation system will operate in two key phases:

Bootstrapping Phase:

Delegator Rewards: In this phase, delegators will earn Sync tokens from liquidity pool fees and IAG tokens generated by running IAGON nodes.

Purpose: This phase is designed to incentivize early network participants, ensuring that they benefit from the initial setup while providing security to the network.

Expansion Phase:

Revenue Kicks In: As more nodes are introduced and revenue generation increases, the treasury will refill. This creates a circular economy where delegators continue to earn Sync tokens from liquidity pool fees and IAG tokens, while node operators are incentivized for maintaining network security and uptime.

Treasury Refill: The revenue generated from various sources (subscriptions, transactions, etc.) will fuel the treasury, which will be used to further reward delegators and maintain liquidity.

2.6.3 Delegation Fee

Delegation Fee: A 0.x% fee is charged whenever a delegator stakes Sync tokens to a node operator. This small fee ensures the smooth operation of the delegation process.

Node Operator Fee: A x% fee is applied when node operators perform operations, creating a system of accountability while contributing to the treasury’s growth.

Node Operation Details

Phase 0

Future Phases

Total Nodes

X Nodes

Gradually Increase

Node Rewards

Sync Token Rewards

Adjusted per Phase

Delegation Fee

0.x%

Constant

Node Operator Fee

x%

Constant

Slash Penalties

Slashing of 2.5% of Self-Stake

Slashing Varies

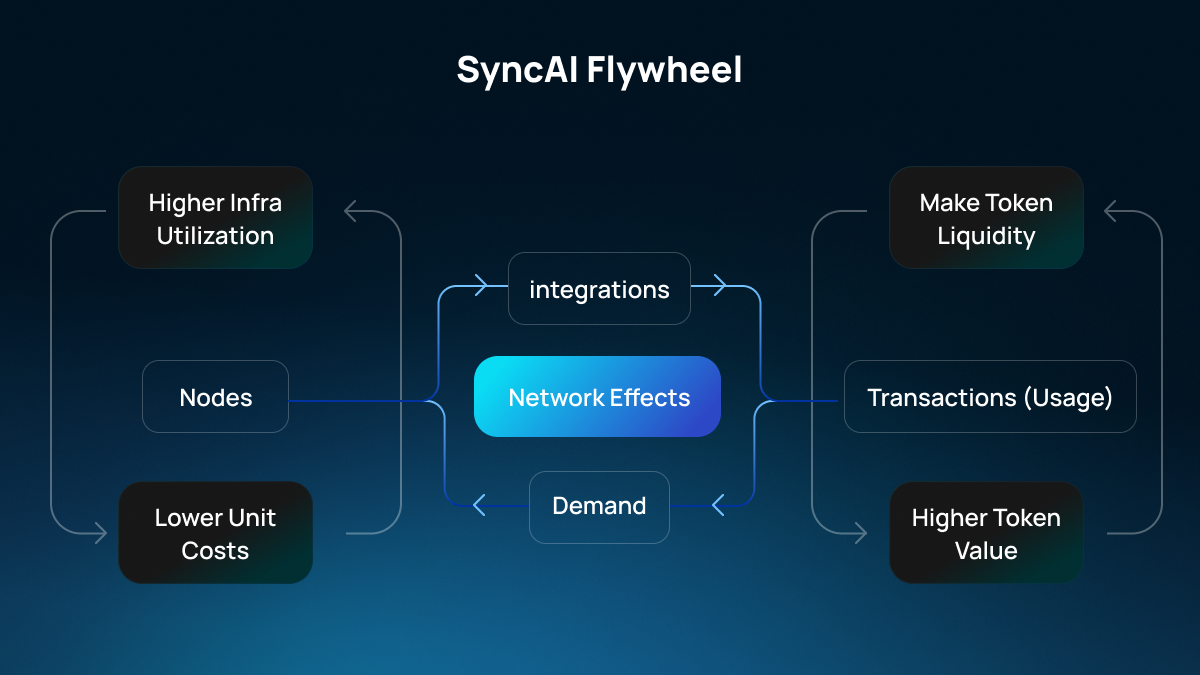

3. SyncAI Flywheel

The SyncAI flywheel demonstrates how every interaction in the Sync ecosystem creates a self-reinforcing cycle of growth. With each step, token utility increases, liquidity strengthens, and demand rises—benefiting all participants within the ecosystem.

Action

Effect

Result

1

Integrations (Initial) → Increased Transactions on the Network

- Expanding Ecosystem: More platforms, dApps, and projects integrate with SyncAI, boosting transaction volumes across the network.

- Network Usage Growth: Higher transaction activity drives Sync token utilization and adoption.

2

More Transactions → Higher Token Liquidity

- Increased Market Activity: Greater network usage results in more Sync tokens circulating in the market, improving liquidity.

- Enhanced Token Trading: More liquidity attracts traders and participants, stabilizing the token economy.

3

Higher Token Liquidity → Higher Token Value

- Market Confidence: Liquidity strengthens token stability and increases value.

- Token Appreciation: Rising value creates incentives for users to hold, stake, and engage.

4

Higher Token Value → Demand for More Integrations

- Attractive Ecosystem: Higher token value motivates other projects to integrate with SyncAI.

- Network Expansion: New integrations further expand SyncAI’s ecosystem, driving more activity.

5

More Integrations → Greater Infrastructure Utilization

- Infrastructure Efficiency: Increased activity optimizes the use of SyncAI's infrastructure, generating higher returns per node.

- Scalable Operations: More infrastructure utilization supports the growing demand.

6

Greater Utilization → More Node Operators Needed

- Node Expansion: Higher infrastructure demand attracts more node operators to the network.

- Decentralization Boost: More nodes improve performance, security, and reliability.

7

More Nodes → Lower Unit Costs

- Operational Efficiency: A decentralized network of nodes reduces operational costs per transaction.

- Competitive Pricing: Lower costs attract more users and developers.

8

Lower Unit Costs → Incentivizes New Integrations

- Affordable Integration: Projects find it cost-effective to integrate with SyncAI.

- Flywheel Restarts: More integrations trigger the cycle again, amplifying network effects and growth.

Summary: The SyncAI Flywheel in Motion

Integrations drive network transactions, building token liquidity.

More liquidity increases token value, attracting further integrations.

Higher token value leads to greater infrastructure utilization, requiring more node operators.

More nodes lower unit costs (economies of scale), creating incentives for even more integrations.

This self-reinforcing cycle accelerates SyncAI’s ecosystem growth, enhancing token value and operational efficiency while continuously attracting new participants and integrations.

4. Fee Market and Burn Mechanisms

The SyncAI token economy employs a governance-led fee committee to ensure sustainable growth and value accrual. This framework adapts to network demands through strategic fee adjustments and systematic burns.

Fee Committee Strategies

Dynamic Fee Adjustments: Regularly optimize fees based on network activity and market conditions.

Strategic Allocation: Allocate revenue to staking rewards, liquidity, and ecosystem development.

Governance Proposals: Community-driven decisions on fee structures and burn initiatives.

Burn Mechanisms: Implement governance-based burns to stabilize the token supply.

Slashing and Systematic Burns

Burn Strategy

Percentage

Purpose

Market Buyback Burn

x% of total revenue generated per month

Reduce token supply through strategic buybacks.

Liquidity Pool Allocation

x% of total revenue generated per month

Ensure liquidity stability within DeFi components.

On-Demand Burns

Variable

Governed by community votes to control inflation.

4.1 Fee Market for SyncAI

The SyncAI platform employs a structured and adaptive fee market model, drawing inspiration from modern blockchain economics. All interactions on the platform incur a base fee charged in $SYNC tokens, ensuring network stability, predictable fees, and secure operations. This fee model integrates burn mechanics and priority-based processing to ensure scalability and sustainability.

Base Fee Structure

Predictable Fees with BaseFee: Every interaction on SyncAI is charged a BaseFee, ensuring that the cost remains transparent and easy to estimate for users. This BaseFee serves as the minimum cost for transaction inclusion, adjusted dynamically based on network demand.

Proportional Burn Mechanism: A portion of the BaseFee is automatically burned, and the proportion of tokens burned increases with total fee volume. This introduces deflationary pressure on the token supply, reinforcing long-term token value and incentivizing healthy network usage.

Security Mechanism Against Attacks

Fee Cap for Resilience: During periods of attack or congestion, the protocol allows the community to vote to increase the BaseFee by 3x to 4x, significantly raising the cost for attackers. This mechanism, similar to the "fee cap" concept in EIP-1559, makes spamming and denial-of-service attacks increasingly uneconomical.

Attack Burn Incentive: The additional fees collected during an attack are also subject to the burn mechanism, accelerating deflation and turning malicious activities into a counterproductive effort for the attacker.

Priority Transaction Modelling with Tip Fees

Tip Fee for Faster Inclusion: To optimize transaction inclusion time, SyncAI introduces a tip fee mechanism, allowing users to add a priority fee (referred to as a TipFee) on top of the BaseFee. Transactions with higher TipFees receive faster inclusion, ensuring critical interactions are processed swiftly.

Transaction Prioritization Logic:

BaseFee Only: Standard inclusion within the next block.

BaseFee + Moderate TipFee: Priority processing with higher chances of faster inclusion.

BaseFee + High TipFee: Top-priority processing with near-instant inclusion.

Dynamic Slot Allocation Based on Total Fee: Validators process transactions based on the sum of BaseFee and TipFee, with higher-paying transactions prioritized. This ensures efficient block space utilization during peak periods and allows users to fine-tune transaction urgency.

Burn Mechanism on Tip Fees: A portion of the TipFee is also burned, further tightening the token supply and aligning with the deflationary nature of SyncAI’s tokenomics.

Economic and Security Benefits

Efficient Block Space Utilization: The BaseFee ensures fair access to block space, while TipFees incentivize users to contribute higher fees only when required, preventing inefficient bidding wars.

Mitigating Spam with Dynamic Fees: Similar to Ethereum’s EIP-1559, increasing BaseFees in response to network load ensures that spam attacks become exponentially costlier over time, discouraging malicious actors.

Enhanced User Experience: With predictable BaseFees and clear TipFee guidelines, SyncAI offers users a straightforward method for controlling transaction speed and cost, improving the transaction fee estimation process.

This adaptive fee market model balances predictability, scalability, and security, ensuring that the SyncAI network remains robust even during periods of high activity or malicious attempts. Through the combination of BaseFees, TipFees, dynamic burning, and priority inclusion, SyncAI guarantees a seamless, fair, and sustainable user experience.

Slashing Penalties: Poor-performing nodes face penalties, with 50% of rewards burned and 2.5% of self-stake slashed.

Governance-Driven Enhancements

Evolving Burn Strategies: Adapt burn mechanisms based on token velocity and market trends.

Fee Redistribution: Reward active contributors and node operators.

Strategic Buybacks: Revenue from investments directed toward further buybacks and burns.

This adaptable framework ensures the SyncAI token economy remains resilient, fostering long-term value through community involvement and strategic management.

5. Summary

The SyncAI token economy is designed for sustainable growth through a combination of transaction fees, staking rewards, governance participation, and developer incentives. With the flywheel effect accelerating adoption, and a dynamic fee and burn model maintaining token value, SyncAI ensures long-term success for participants across the Web3 ecosystem.

Last updated